The 8-Minute Rule for Steve Young Realtor

Table of ContentsFascination About Steve Young RealtorHow Steve Young Realtor can Save You Time, Stress, and Money.How Steve Young Realtor can Save You Time, Stress, and Money.The Ultimate Guide To Steve Young RealtorSteve Young Realtor for BeginnersThe smart Trick of Steve Young Realtor That Nobody is Discussing

/real-estate-vs-stocks-which-is-the-better-investment-357992_final-68cce93ae0e8483395d1e7c47368e8b5.png)

If you buy as well as hold actual estate, you'll desire to rent it out to make money., they aid you get matched with a quality property administration business in the area.

They can buy realty yet not have the headache of managing the property themselves. Securing financing for an owner-occupied residential property is normally easy if you have respectable credit history and also secure revenue. You'll need a little down repayment as well as can generally guarantee the remainder in the type of a fixed-rate or adjustable-rate loan.

Steve Young Realtor Fundamentals Explained

They usually have more stringent demands, including higher credit rating, lower debt-to-income ratios, and also a lot higher down payments. For instance, lots of lending institutions need 30% of the purchase rate down on the house to protect funding even if you have excellent credit history. There's no guarantee that you'll constantly have renters. If your tenant's bond on you, the mortgage and also costs fall on your shoulders.

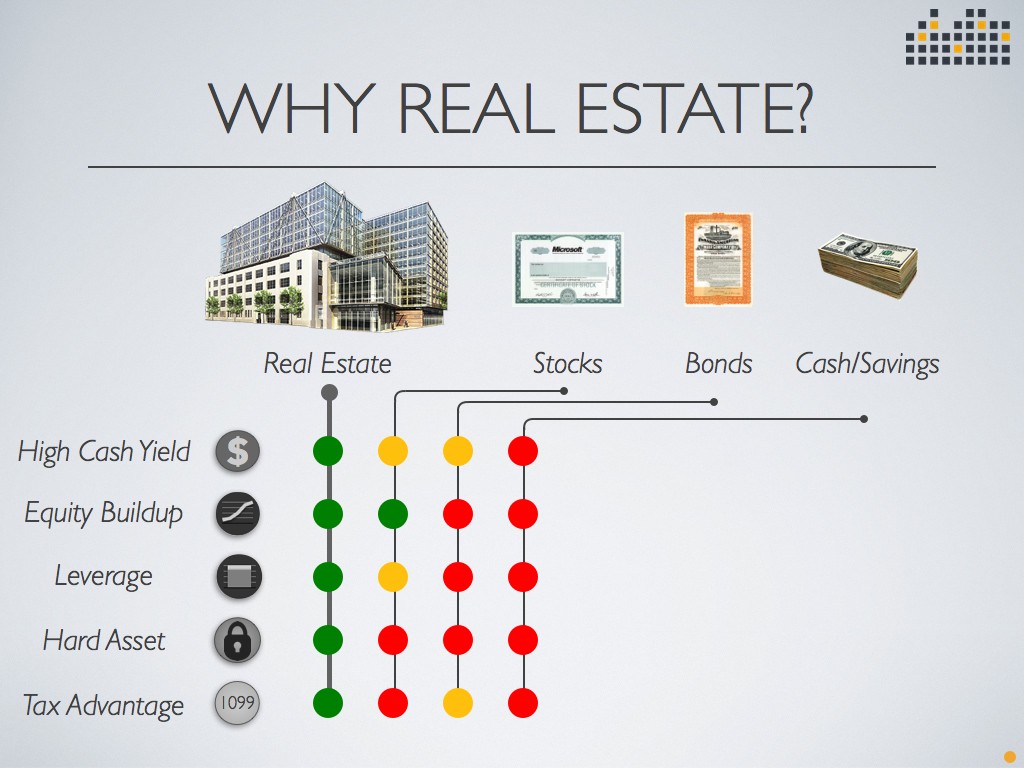

You require a solid reserve and also be secure in your funds to manage any circumstance that might come your method. All-time Low Line Real estate is a fantastic method to expand your investment profile. You can offset the risk of high-risk financial investments, such as cash bought the stock market.

Actual estate investing in Oklahoma City is/was one of the most intelligent actions I've made. This post focuses on all the reasons realty investing in Oklahoma City is STILL a sensible relocation. Recognize Oklahoma city's actual estate market in detail. In 2014, my little girl and also I were walking in downtown Oklahoma City.

The Ultimate Guide To Steve Young Realtor

7%). If you desire details regarding Aspects Impacting Property Market, have a look at this write-up where you can discover how Demographics affect the Oklahoma city property market. Oklahoma City City Location Economic situation One often mentioned myth regarding the Oklahoma City city location economy is that it is extremely reliant upon the oil as well as gas organization.

Learn more about the Top Reasons to Spend in Real Estate in Oklahoma City Closer check out the Real Data tells a Various Story As you can see below, one-fifth of the work in the Oklahoma City metro location are government jobs. The 4 leading employers in the location consist of the State of Oklahoma, Tinker Air Pressure Base, The College of Oklahoma, as well as the Federal Aeronautics Administration.

The Basic Principles Of Steve Young Realtor

The Economy expanded throughout most of the 2000s According to the Comprehensive Oklahoma City Housing Market, the economic situation increased throughout the 2000s. 3%, and also just decreased 1.

That consisted of the building and construction of the basketball sector to hold the NBA Oklahoma City Rumbling, a baseball arena and also canal in Bricktown, and also lots of other tasks around the city. I'll chat a lot more regarding how the MAPS has actually affected the quality of living below.

During the steady financial duration during the 2000s, the unemployment of the Oklahoma City city area was 4 - steve young realtor. Oklahoma City City Location Home Sales Median residence sales costs in the Oklahoma City metro area have actually been on a good increasing fad because the housing collision of 2009-2010.

Steve Young Realtor - Truths

Sales price in the The real estate market is stable. According to the comprehensive Real estate Market Evaluation, 3. 1% of homes in the Oklahoma City city location were seriously overdue (90 days or even more or in foreclosure), or had transitioned to bank-owned (REO) standing. That contrasts to a national average of 6.

That contrasts to a nationwide standard of $1,097, up 1. 9% from the previous year. The typical openings rate in the OKC metro area in 2017 was 8. 5%, down 0 (steve young realtor). 6% from in 2015. That contrasts to a nationwide average of 6. 0%, down 0. 2% from the prior year.

6% in the OKC city, down 1. 7% from the prior year. That contrasts to a nationwide standard of 20%, down 0. 5% from the previous year. How to obtain rental earnings!.?.!? Here is a solution. Factors Property Investing in Oklahoma City Makes Good Sense It's absolutely feasible to discover residential properties that make feeling from a long-term investment standpoint in the OKC property market.

Getting The Steve Young Realtor To Work

Development and Stability of Oklahoma City Real Estate Market It's clear the economy of the Oklahoma City city location is on solid ground. Spending in genuine estate in Oklahoma City would not be nearly as appealing if the work sector was weak.

5% last year. Read: Should You Think About Real Estate Collaboration Investment? Quality of Life Improvements In 1991, Oklahoma City lost the possibility to bring a United Airlines upkeep center to Oklahoma City. The decision not to bring that center, according to United, was based mainly upon the top quality of living in Oklahoma City at that https://steveyoungrealtor.com time.